The economic winds are showing signs of changing. The tailwinds produced by the economic stimulus of COVID-19 that once had the strength of the jet stream have shown signs of dissipating:

- According to the San Francisco Fed, pandemic-era excess savings have finally been exhausted.

- Inflation, while elevated at the time of writing, has reduced from its high of 9.1% in June 2022 to a less discomforting 5% as of March 2024 (as measured by CPI).

- Today, the unemployment rate has ticked up from its cycle low of 3.4% to a more tepid 3.9%, approaching the Sahm rule recession indicator.

This all goes without discussing the inverted yield curve, which deserves mention, but the bond market has priced this cycle completely wrong since the beginning.

While the present situation may be evolving, it has been fascinating to see both bulls and bears in agreement: the Federal Reserve needs to cut rates. What the two sides don’t agree on is why.

We’ll review the various arguments that are tossed around for why the Federal Reserve needs to cut interest rates and discuss the economic merits of each of them, from an armchair economist.

Economic slowing

Breaking down the argument

This is the “vanilla” argument for rate cuts, so we will not spend a lot of time for discussion. The Federal Reserve uses monetary policy (which includes, but is not limited to, setting a target range for interest rates) to counteract the effects of the business cycle. The two goals for the Federal Reserve are to control inflation and to promote maximum employment, which is referred to as the Federal Reserve’s “dual mandate”.

Analysis of the argument at the time of writing

Today, this argument holds some strength, but overall in the face of current data, remains weak: inflation remains elevated, the economy is expanding at a healthy pace, and the labor market remains strong. At the time of writing, the only argument for a cut on this basis would take the form of an “insurance” cut, to guard against the downside risk of “accidentally breaking something”, similar to the 2019 mid-cycle adjustment.

The ballooning cost of US debt

Breaking down the argument

This is one of the more novel arguments. It is important to remember that the United States runs a fiscal deficit; it spends more money than it takes in. This shortfall in income must come from somewhere, so the US borrows money. This borrowed money takes the form of Treasury bonds. When the Federal Reserve increases interest rates, it also increases the interest rates on the debt that the US takes out. In other words, elevated interest rates make it more expensive for everyone, including the US Treasury, to borrow money.

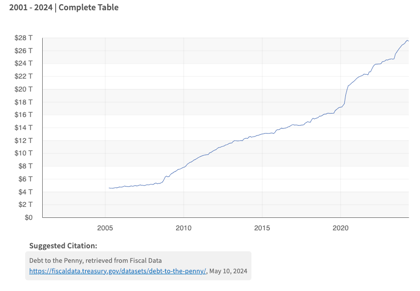

The graph below shows the US Debt “to the Penny”:

Presently the total public debt is approximately $34.54 trillion dollars.

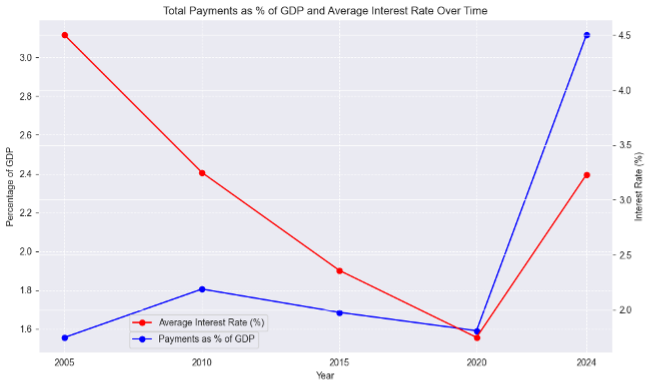

It is crucial to understand the large amounts of the interest payments that the Treasury must make, not due to the amount of debt but rather due to the combined effects of the level of debt and the level of interest rates.

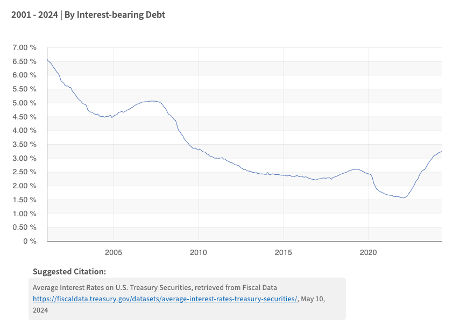

Below is a graph of the rate of the average interest rates on U.S. Treasury Securities, from the US Treasury Fiscal Data:

The amount of debt payments can be estimated based on the interest rate multiplied by the total level of debt. Therefore, you can estimate total payments owed by the Treasury over time. Then, to consider it as a percentage of total GDP to account for effects of economic growth over time.

The crux of the argument is that the level of debt, combined with the level of interest rates, places the country in an untenable financial position, as interest payments are presently approaching 5% of annual GDP.

Analysis of the argument at the time of writing

This argument is fundamentally strong if you consider that a country must be solvent and carry a balance sheet like a household or business. However, monetarists would argue that the US can always create more currency and “inflate away” the debt.

Unequal cost of inflation and credit

Breaking down the argument

A common refrain from the Federal Reserve is that inflation disproportionately harms those who earn lower wages. Throughout research, this fact tends to be generally agreed-upon. The argument from policymakers is that, by increasing interest rates, they will decrease inflation. However, it is important to remember that those most harmed by inflation are also those most harmed by higher interest rates.

The economy can be split into two groups: wealth management and debt management.

Lower wage earners also are more likely to be borrowers. Higher interest rates squeeze borrowers as their payments increase due to the increased interest costs.

Increasing interest rates has the effect of increasing yields, and therefore income, for the sector of the economy that is obtaining wealth management. This creates the opposite of the intended effect of decreasing income.

Analysis of the argument at the time of writing

This argument is logical, but there has been limited data to verify this claim. Due to the lack of research and data, this argument is insubstantial.

“Real interest rates have become overly restrictive amid falling inflation”

Breaking down the argument

Economists distinguish between concepts as being either, “real” or “nominal”. An indicator that is real is inflation-adjusted, whereas nominal indicators are not inflation-adjusted. In other words, real interest rates are interest rates that have been adjusted for inflation.

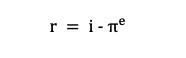

The famous equation, the Fisher equation, states that real rates are equal to the nominal rate less expected inflation:

If the nominal rate is 5%, and the expected inflation is 2%, then the real rate would be 3%. Now, consider what happens when inflation expectations fall and the nominal rate stays the same. Suppose that the nominal rate is 5% but the inflation expectations fall to 1.5%. The real rate is now elevated higher at 3.5%.

Remember that economic participants borrow at the real rate of interest, not the nominal rate of interest.

Essentially, if inflation is reducing and interest rates are not also falling at the same time, then the monetary policy is becoming more restrictive.

Analysis of the argument at the time of writing

This is a thoughtful and academic argument, and the Fisher effect has been verified as a long-term phenomenon in a 100-year look-back study of US data.