ABOUT ME

WHO AM I?

I'm a mortgage industry professional with 7+ years of experience in operations management, sales, and marketing. Proven success with managing and growing successful mortgage companies with emphasis and competencies on systems, data analytics, and technology.

SKILLSET

I bring a very different problem solving approach due to my background in mortgage lending, capital markets, data science, and software engineering. The end result is that the solved problems are often based on quantitative methods and tend to employ code and interfaces for users to interact with.

LEADERSHIP

CAPITAL MARKETS

MORTGAGE LENDING

MACHINE LEARNING

SOFTWARE ENGINEERING

EDUCATION & ACHIEVEMENTS

EXPERIENCE

BLOG ARTICLES

Understanding the Various Arguments for Why the Fed Needs to Cut Rates

The economic winds are showing signs of changing. The tailwinds produced by the economic stimulus of COVID-19 that once had the strength of the jet stream have shown signs of […]

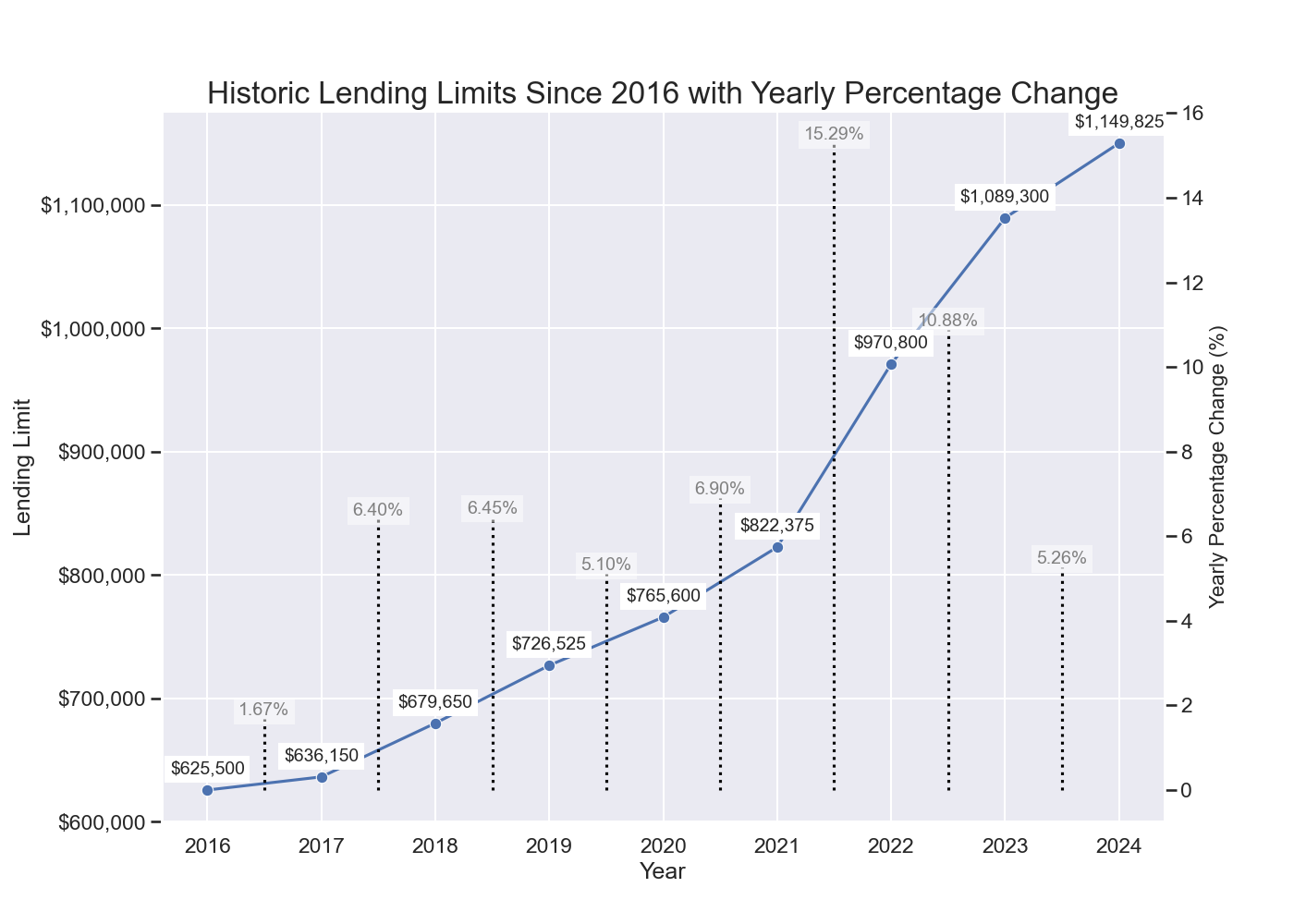

Analysis of Lending Limit Increases for HECM Borrowers

In semi-recent news, the Federal Housing Finance Agency increased the lending limit on conforming loans for 2024. Understanding the HECM Program The Home Equity Conversion Mortgage (HECM) program, integral to […]

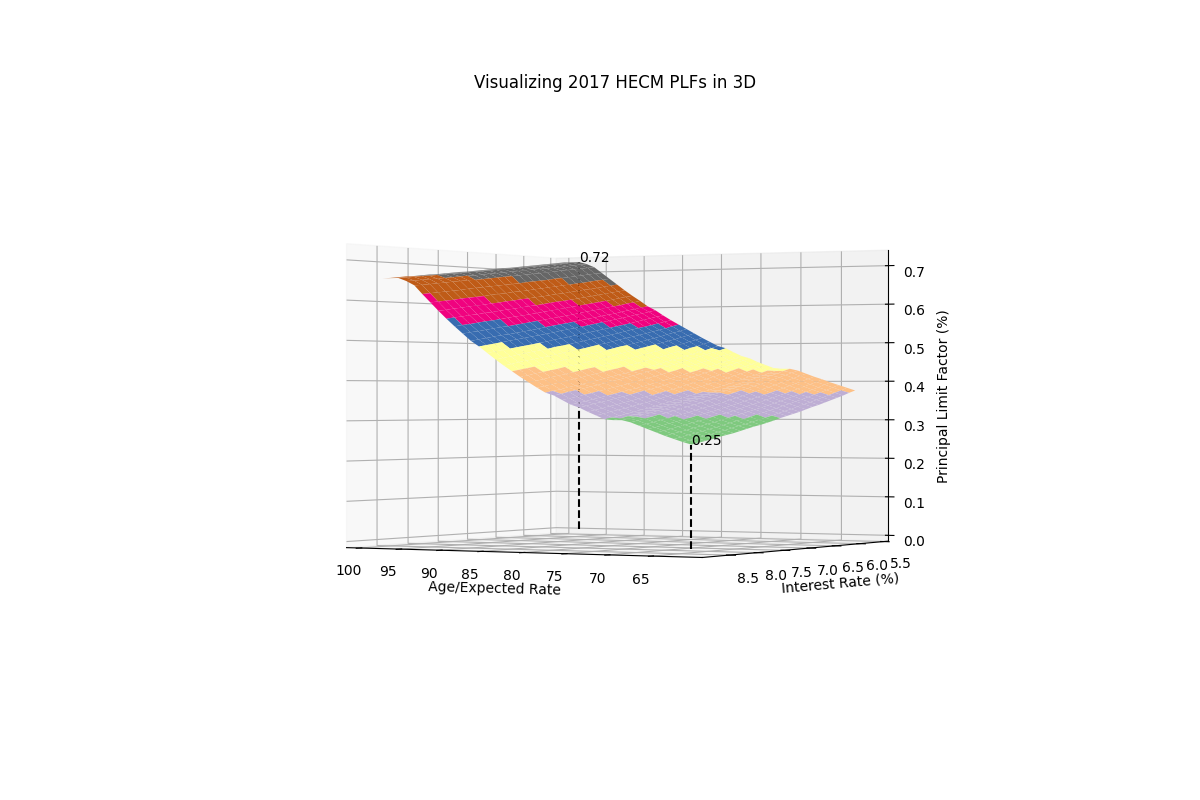

Visualizing HECM Principal Limit Factors & How Rates and Age Affect Them

I think everyone in the reverse mortgage space has probably heard these anecdotes: “As borrower age increases, the amount of money the borrower qualifies for increases” “As interest rates decrease, […]

CONTACT INFORMATION

tyler@tplack.com